In the United States, there are primarily three sorts of taxation: federal, state, and local. When these are added together, the total amount of tax that must be paid or withheld can be determined. Tax rates vary across the 50 states if you desire about incorporate company in USA.

Paychecks, bequests, gifts, dividends, and sales, investment, and import gains are all subject to taxation in the United States.

American Taxation

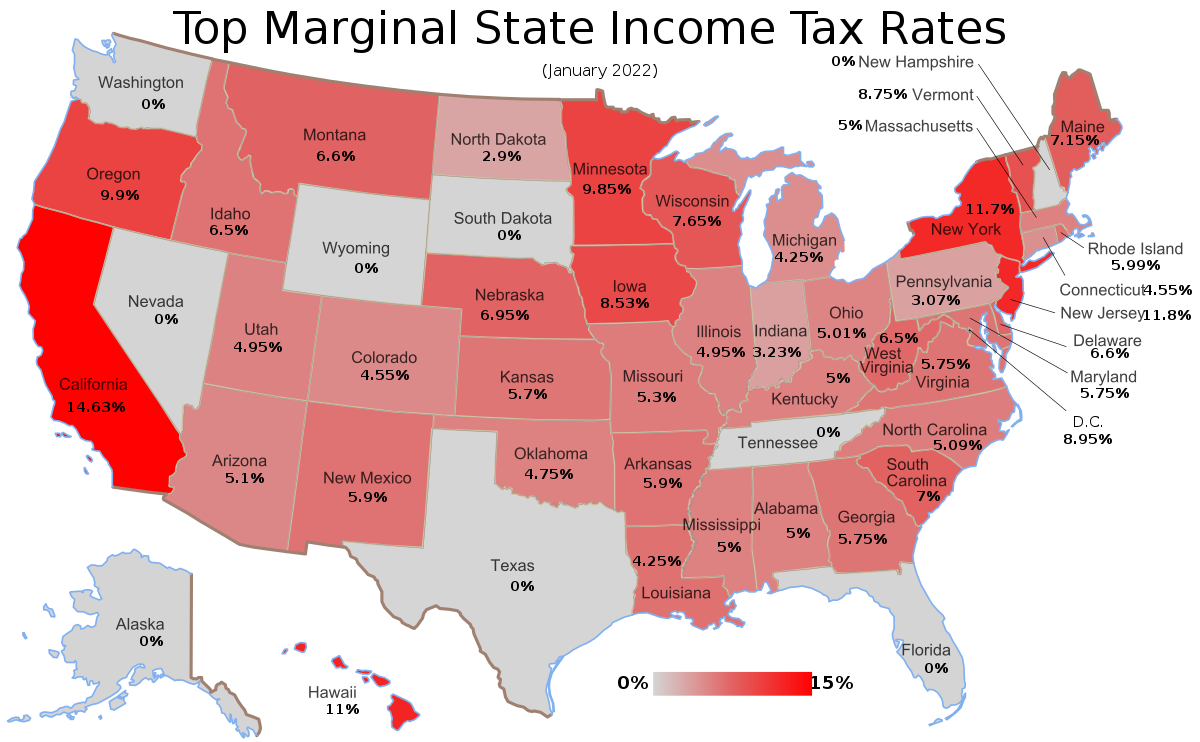

Earnings from freelance or independent work, salary, capital gains, tips, and real estate earnings are all subject to taxation. Your tax obligation is calculated by taking into account your income, state of residence, and locality. The percentage of income that is subject to taxation varies widely from state to state, ranging from 2.9% in North Dakota to 13.3% in California. According to Taxation in the USA, there are three distinct tax categories to take into account.

Federal Tax

The “Federal Tax” component of a U.S. taxpayer’s income tax return goes straight to the Internal Revenue Service and is the government’s primary source of revenue (IRS). Funding for critical initiatives including education, disaster relief, and infrastructure improvement comes from the Federal Tax.

State Tax

Individuals in some U.S. states are exempt from paying state income taxes. Many states do not impose a tax on individual earnings. They include Delaware, Florida, Wyoming, Nevada, Washington, Alaska, South Dakota, and Texas.

Furthermore, the tax rate differs from state to state and, depending on the form, may be a flat rate or a graduated scale. Health and education receive the lion’s share of state income tax funds. On the other hand, the tax money goes toward things like public housing, parks, recreational centers, public transportation, and military expenditures.

Local or Community Tax

Local or Community Taxes can be levied by any municipality that chooses to do so. Hence, it is not available in all American cities and towns.

The money collected from the municipal tax might go toward a variety of projects, including the upkeep of public spaces like streets and libraries, the removal of waste, and the repair of sewage systems.

American tax brackets and filing thresholds

- The vast majority of Americans pay taxes in a variety of forms. This holds true not only for the federal income tax but also, in some cases, for the income tax levied by individual states.

- Different portions of your income are subject to taxation at different marginal rates, and this is done automatically for you.

- There are seven separate tax brackets, starting at 10% for very low incomes and going as high as 37% for extremely substantial gains.

- The marginal amounts are typically revised on a regular basis to account for inflation.

- Before beginning work in the United States, you should calculate your possible federal income tax payments.

Do I have to file taxes if I have a green card?

In the United States of America, it is crucial to be a responsible citizen who is well-versed in their rights and responsibilities. Having a Green Card makes you a “Permanent Resident” of the United States for tax purposes. If you have a Green Card but are not yet a resident, you may be eligible to pay lesser taxes as a result of a double taxation arrangement.

Conclusion

In contrast to India’s centralized taxation system, the United States has separate federal and state taxes systems. The Federal Revenue Service claims that the average taxpayer spends 12 hours gathering the necessary information and filing their return. When comparing tax systems around the world, countries like Belgium, Spain, and Denmark have much more straightforward procedures. Yet, the IRS maintains that the forms in the schedules are really intended to aid and save money if the filer is knowledgeable about the tax code. If you want then you can also hire US tax preparers in India to lessen your burden. The taxpayer is responsible for reviewing their spending habits throughout the year and making adjustments as necessary to minimize tax obligations.