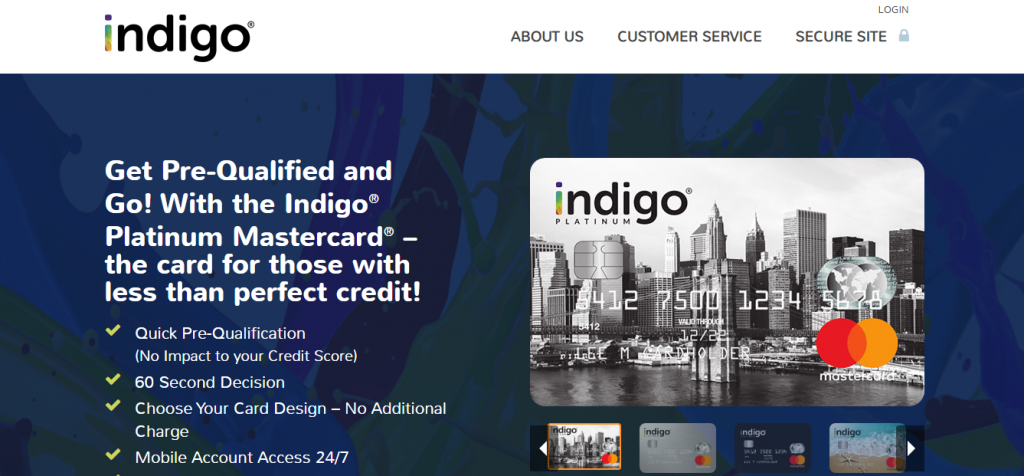

As stated on their website, “people with less than excellent credit” may want to consider the Indigo Platinum Mastercard, although it may not be the best choice for them. Here, you will find the Indigo Platinum Card Login, Registration, And Lost Password Guide.

This card, issued by Celtic Bank in Utah, is available in a rainbow of colors and styles, but don’t let that fool you; it may have some hefty fees attached to it. It’s a pricey method to start establishing credit, but it’s an option. There are preferable choices available even to individuals with weak credit.

In spite of its advertising to individuals with poor credit, the Indigo Mastercard actually aids in maintaining the same system that purports to assist them.

Debt-to-credit ratio, or credit usage ratio, is a key indicator in calculating a credit score. When trying to keep your credit score in good shape, it’s recommended that you never utilize more than 30% of your total credit limit.

The Indigo® Mastercard® for Less than Perfect Credit login page may be found on the Genesis Financial Solutions website. Here, you’ll be able to input your username and password to access your account. Once you’re there, choose “Log in” to enter your account information. Select “Register” to create a login name and password if you haven’t already.

How to Access Indigo Platinum Card Online:

Here is the Step-by-Step Guide to Accessing Your Indigo Credit Card Account Online.

- Sign up for online access to your Indigo Credit Card account. To verify your credit card account, choose “Register,” then enter your account number, date of birth, and Social Security number.

- Decide on a user ID and password for your Indigo Credit Card account. In both the user name and password fields, spaces are forbidden.

- To continue, please enter your new Indigo Credit Card login details. Simply enter your new username and password into the corresponding areas on the Genesis Financial Solutions login page, and then click the corresponding “Log-in” button.

If you have an Indigo Credit Card and have registered and logged in, you may see your account information and make changes online. You may manage your credit card account in a number of ways, including making payments, viewing statements, keeping tabs on purchases, and modifying recurring payments and security questions.

Genesis Financial Solutions has a link labeled “Forgot your Username or Password?” should you ever forget your credentials. Then, simply stick to the on-screen directions to restore your old credentials or change your new ones.

Unique Advantages of Indigo

Detailed information about this card is provided below.

Useful For Establishing a Solid Credit History

The Indigo Platinum Mastercard provides credit bureau reporting via TransUnion, Equifax, and Experian. That’s great news for anybody working to improve their credit since the data collected by these agencies is what lenders use to determine your creditworthiness.

These ratings are heavily weighted toward payment histories. If you maintain a positive payment history, you may be offered upgraded credit in the near future.

But there is a chance that it may cost you.

There may or may not be an annual fee based on your credit history. But if your credit is less than stellar, you should expect to pay a yearly maintenance cost of $59 to $99. The standard $99 annual charge is reduced to $75 for the first year for new cards.

The less attractive this card is, the greater the yearly charge. Once instance, you could put up a few hundred dollars. After that, use it as a deposit on a secured credit card. It would help you establish credit and return your initial investment after you’ve shown responsible card use. (You can’t get your money back if there’s an annual charge.)

Moreover, the card has a variable interest rate of 23.9% APR (rate accurate as of March 2019). That’s about par for the course for a card designed for those with low credit scores. Nonetheless, this entails a high cost for maintaining a credit card balance.

Unfortunately, the credit limit is rather minimal.

The maximum amount you may borrow is $300, and that might go down because of interest and other charges. For an account that costs $59 per year to maintain, for instance, the issuer may reduce your initial credit limit to $241 to account for setup and maintenance costs.

It’s easy to run up a high credit usage with such a modest credit limit. It might affect your credit just as you’re starting to rebuild it. It’s not reasonable to pay a steep yearly charge for a credit line that is below the very minimum required to open a bank account.

Again, if your credit isn’t great, a secured credit card may be your best alternative. It is because the credit limit is usually equal to the amount you deposit.

A possible exception is the Capital One Platinum Secured Credit Card. If you put down either $49 or $99, or even $200, your first credit limit will be $200 with this card. After making timely payments for as little as six months, you may be eligible for a credit line increase. And if you keep up an excellent payment record, you’ll receive back everything you put in. Also, unlike the Indigo card, there is no hefty annual charge.

Some subsidiary advantages

The Indigo Platinum Mastercard comes with all the standard Mastercard perks, such as extended warranty protection and travel support.

Moreover, being a Mastercard, it may be used conveniently and safely when traveling. Although some credit cards don’t charge any fees at all for using them abroad, this one performs at only 1%.

Conclusion

To spend more than 30% of one’s available credit is a choice, and for those who must do so at the expense of creditworthiness, it’s a matter of survival. In a situation when there is a threat to the family’s ability to put food on the table, what value does “credit” have? However, issuers may profit when customers are unable to break the cycle of paying high yearly fees and high-interest rates in order to cover basic expenses. Enjoy your card as now you know the Indigo Platinum Card Login, Registration And Lost Password Guide.